BlackRock Transitions its US managed Fixed Income ETFs

Beginning January 2024, BlackRock will transition its US managed Fixed Income ETFs from iShares Online (iSOL) to the new primary market order taking platform, ESP.

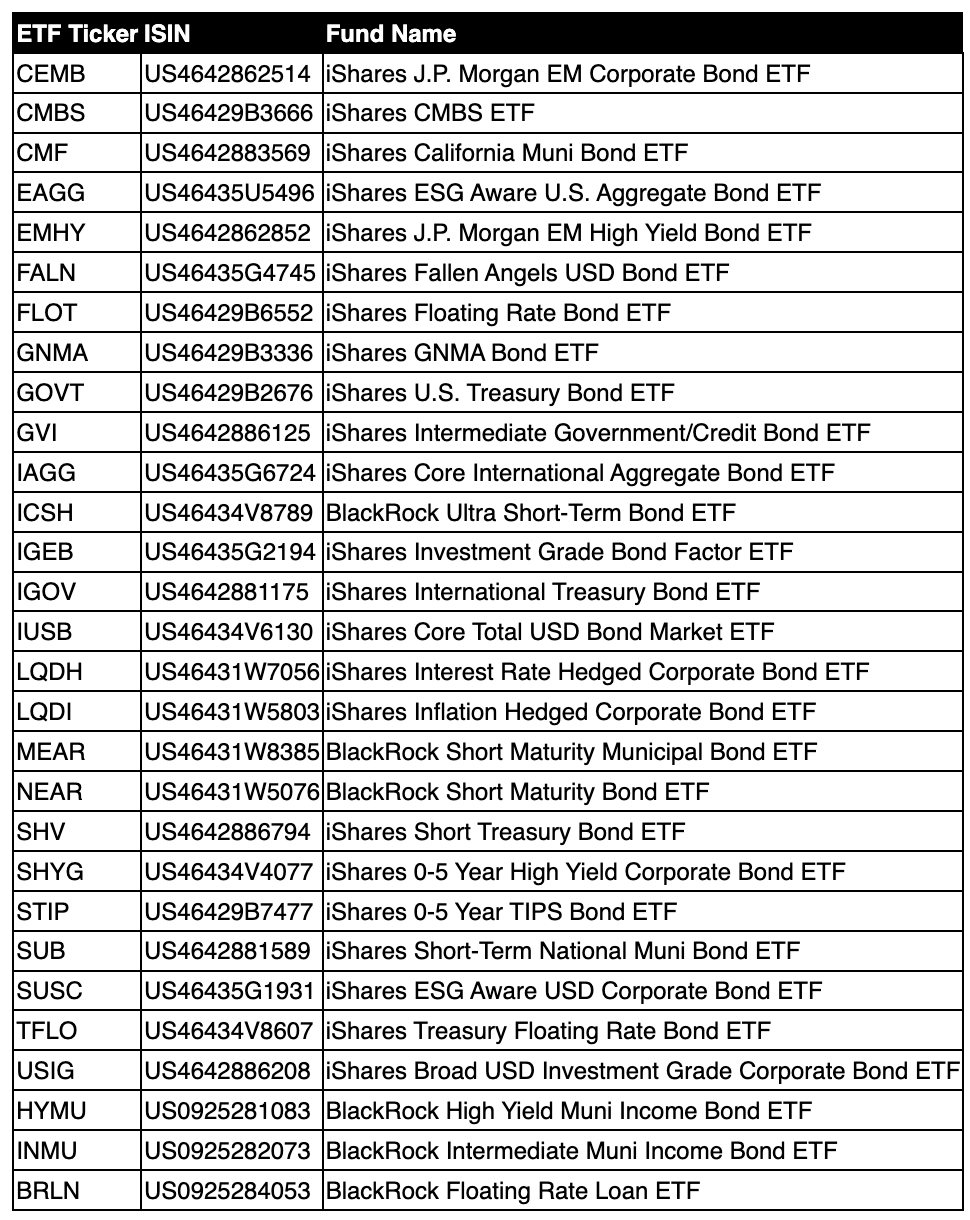

- The below list of US Fixed Income ETFs will discontinue order placement from iSOL at close of business Friday, January 5th , 2024.

- On Monday January 8th , 2024, the below list of US Fixed Income ETFs will begin accepting orders on ESP.

US Fixed Income ETF Primary Market Orders on the new platform (ESP) will transition in 2 phases:

1. January 8th , 2024: For a subset of US Fixed Income funds

2. January 22nd , 2024: Remainder of US Fixed Income funds

Phase 1: January 8, 2024

Subset of US FI Funds to begin order taking on ESP

Phase 2: January 22, 2024

Remainder list of funds to come shortly

No Impact to Order Placement via ICE / FIX

There will be no impact to FIX connectivity should your firm utilize FIX via ICE to connect to the BlackRock order taking portal. However, we stress that all firms log into ESP prior to the go-live date even if they primarily utilize ICE.

Please see the below instructions on how to log in or request access.

ESP Account Login

To transact on our new primary market platform, please ensure you have an account set up on ESP and confirm that you can login prior to the go live dates!

Your iSOL account will not work on ESP.

- We expect a surge in volume of login related requests and the queue could impact your

time to market. - ESP Login link: https://esp-external.blackrock.com/apps/leo/login

- Access Request Contact: GroupiSharesPrimaryPlatform@blackrock.com

ESP API and File Decommissioning

The new source of fund data will be hosted on our External API. As such, we will be

decommissioning the following files:

- The PCF, Non-Basket Report and NAV Proof files will be decommissioned for fixed

income funds as they are added to ESP on January 8 th , 2024.

- iShares.com USFIException Report and USFIINTLException Report will not contain

information on funds as they are added to ESP on January 8 th , 2024. They will be

decommissioned once all funds have migrated to the new platform.

Please ensure your teams are prepared to release code into production by January 5 th , 2024 and be aware of any code freezes on your end that could impact rollout.

ESP differences vs legacy iSOL

- Please familiarize yourself with some of the new terminology and features with ESP.

- iGUB/iSUB process is now enabled with a “Well-Formed” checkbox on the ESP Custom

- Negotiation screen – we are no longer accepting spreadsheets.

- iSOL legacy system had 3 delivery types that resulted in cash delivery: CWE, CIL, SAC

o ESP will consolidate CIL & SAC delivery types into CIL and consolidate Market

Trade & CWE as Market Trade - Approvals workflow – ie. All cash orders, orders in pending acceptance, and

amendments now require approvals in ESP.

Please direct all questions, issues, and concerns to GroupiSharesPrimaryPlatform@blackrock.com.

iShares Capital Markets Group

BlackRock

400 Howard Street

San Francisco, CA 94105

415.670.7090

Americasglobalmarkets@blackrock.com