Data Procurement

International Data Sources

Corporate actions take place in over 100 countries and some individual countries, such as the US, have multiple exchanges and other trading venues. In the US, the NYSE and Nasdaq have different rules on corporate actions for securities listed on their exchanges, but OTC securities are governed by the FINRA regulator.

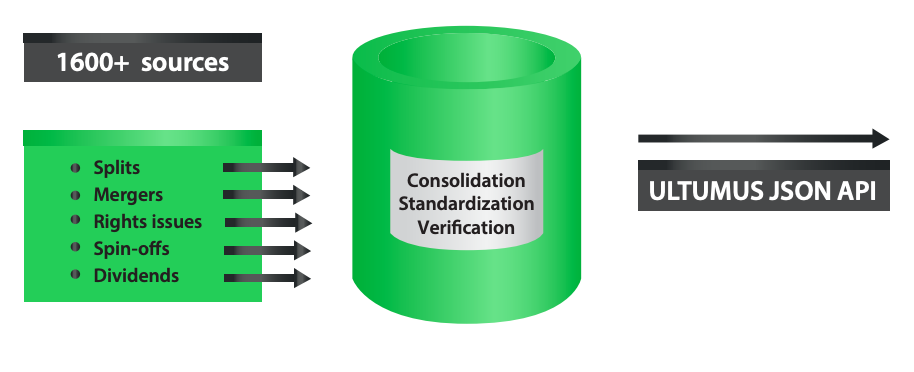

Data sources can include corporate filings, exchange feeds, transfer agents, and newswire services. Primary sources include exchanges. central securities depositaries and issuer agents, with which SIX has built up relationships through connectivity and licensing agreements. Other sources include registrars, transfer agents, paying agents, and fund managers.

Single Source Model

A “Single Source Model” where issuers and/or paying agents provide the initial data to all participants can increase efficiency and timeliness, remove some duplication and interpretation risk, and reduce costs.

A “Single Source Model” has already been implemented in Australia, India, Hong Kong, Russia, Singapore, Slovenia and Switzerland, for some or all types of corporate events, and there is proof of concept in the UK and USA.

ISSA argue that, “the ultimate long-term goal must be a fully standardized, automated single source model across all markets globally”. This is a worthy ambition but it may take many years. For the time being, data needs to be sourced from multiple entities.

Collection Techniques

Manual sourcing of data increases potential for errors. Automation is a more efficient way to collect the data. The raw data can be efficiently collected and manipulated using bulk API.

Comprehensive Coverage

Various providers claim to have comprehensive coverage based on 80,000 or 100,000 companies, in over 100 countries. The number of instruments is also important since some companies have multiple different bond and other fixed income issues, often trading in different countries. Most providers are ongoingly improving their coverage of geographies, exchanges, venues, asset classes and instruments.