DWS joins its own Mittelstand ETF

Europe's third largest ETF issuer, DWS, ascends into Germany's MDAX index

Read More

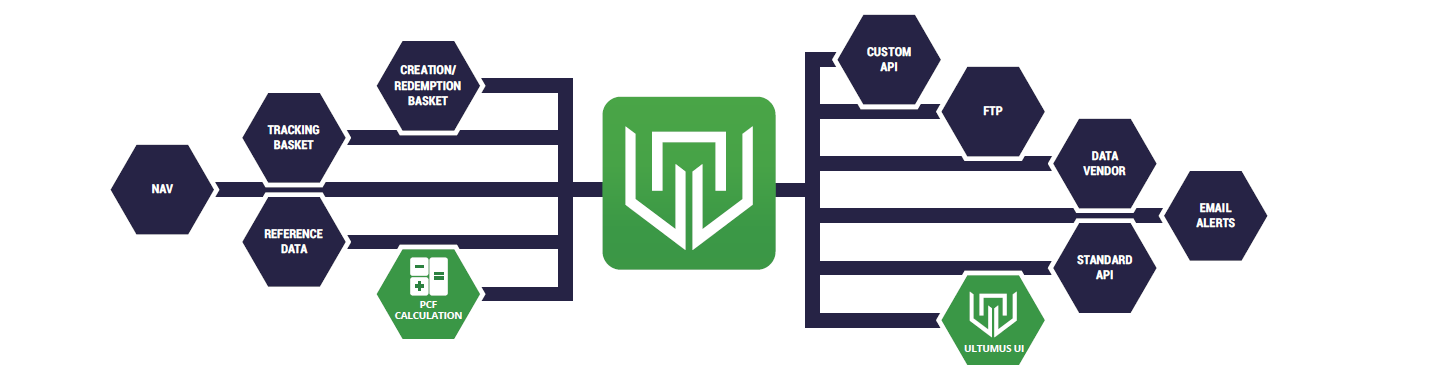

Timely and accurate PCF files are essential for timely and accurate pricing of ETFs by market makers, which contributes towards better market liquidity and tighter bid offer spreads.

PCF files also feed into the arbitrage mechanism that helps to keep most ETF prices very close to their Net Asset Values, most of the time. The PCF file is also used to create and redeem units of ETFs at the correct price.

Users of PCFs include market makers, authorised participants, asset managers, index providers and data vendors.

A PCF could contain cash in one or more currencies, securities, futures or other derivatives, based on equities, fixed income, commodities, currencies, cryptocurrencies and other asset classes. It may need spot and forward exchange rates, for instance where forwards are used for currency hedges.

It should also include identifiers such as ISIN codes, tickers or other identifiers for the securities.

The PCF iNAV (indicative NAV) also needs to define and dynamically update weightings for each instrument, which can change throughout the trading day as financial markets fluctuate. PCF pricing needs to be a close to real time as possible.

A PCF strategy may be in house, outsourced, or a mix of both.

ETF asset managers and market makers might calculate their own PCF files for some products and this can be supplemented and/or replaced by third party PCF calculation. An independent specialist third party PCF calculation acts as a useful way to double check internal calculations, which may sometimes flag up errors.

The guiding star for the industry is a harmonised PCF format, which is helpful for all ETF market participants.

Europe's third largest ETF issuer, DWS, ascends into Germany's MDAX index

Read MoreJupiter | Apollo | Physical Uranium Crypto Index | Dual Exposure ETFs

Read MoreHow the Magic 8 Complement the Magnificent 7 Mammoths Driving the Market Two new...

Read More